Cyber 5 2025: Shoppers Browsed Early, Bought Late and Turned to AI to Decide

How lessons learned from Cyber 5 will pave the way for success in 2026 and beyond.

Against a backdrop of lingering concerns about consumer spending, Cyber 5 2025 delivered a resilient performance. Adobe Analytics reported $44.2 billion in online sales across the period, a 7.7% increase from last year, suggesting shoppers were still willing to spend when the value was clear, echoing what we saw during Prime Day. Cyber Monday led the charge with a record $14.25bn, and Black Friday followed with $11.8bn, both exceeding expectations.

The results suggest that consumers are cautious, but not retreating. Discounts clearly drew shoppers in, but record buy now pay later (BNPL) use, with more than $1bn spent using BNPL on Cyber Monday alone, underscored a lingering uncertainty in how consumers are managing their budgets.

With this context in mind, Wayvia’s data helps reveal how these consumer dynamics played out across Cyber 5 and how retailers and brands shaped the outcomes through their execution.

Shoppers Researched Early But Bought Late

|

Nov 27 , 2025 |

Nov 28, 2025 |

Nov 29, 2025 |

Nov 30, 2025 |

Dec 1, 2025 |

|

|

Purchase Intent Rate |

48.7% |

48.0% |

48.3% |

47.9% |

45.7% |

|

Purchase Rate |

5.0% |

9.2% |

9.1% |

10.7% |

11.7% |

Wayvia’s data shows a clear pattern in how shoppers approached Cyber 5:

-

Interest peaked early, with strong browsing and intent from Thanksgiving through the weekend.

-

Many shoppers held off on buying, waiting for clearer value and better deals before committing.

-

Cyber Monday became the decisive moment, with intent dipping but conversion surging as shoppers finally acted.

-

This pattern reinforces the need for week-long visibility to ensure brands stay present throughout the evaluation window.

-

Brands that maintained timely retargeting and helpful, confidence-building messaging were best positioned to capture conversions once shoppers moved from browsing to buying.

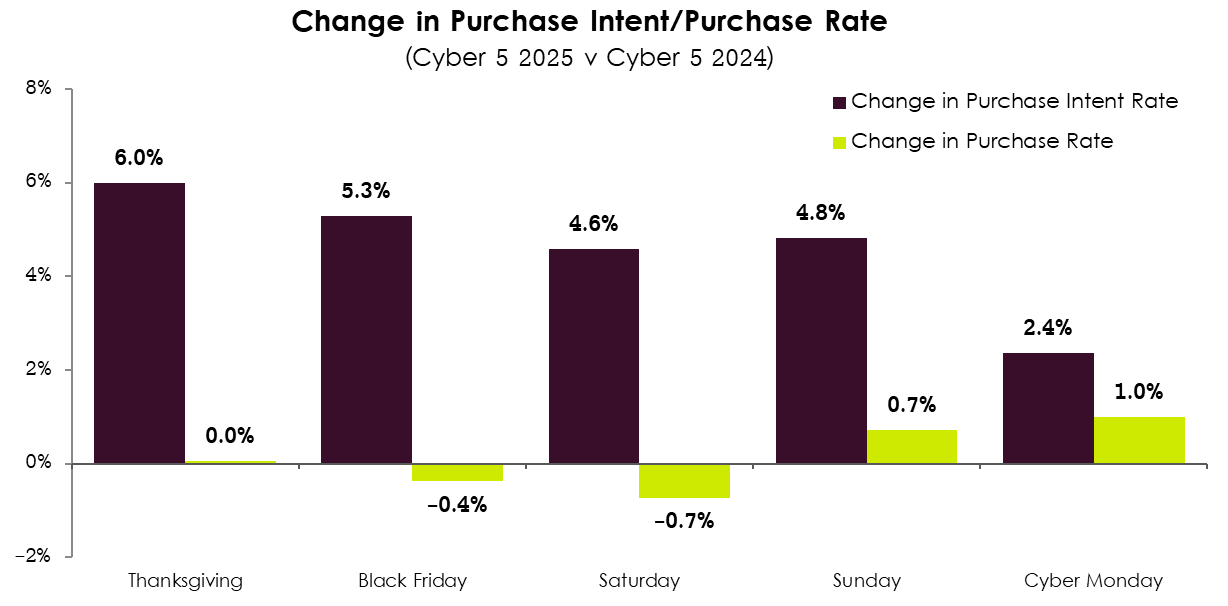

More Intent Than 2024, but Purchases Shifted Toward the End of Cyber 5

Wayvia’s YoY analysis highlights a clearer pattern in shopper behavior:

-

Intent climbed across every day, with Thanksgiving showing the biggest lift (+6.0%) and smaller gains throughout the rest of the week, suggesting that shoppers were more active and curious than in 2024.

-

Early-week conversion lagged, with purchase rates on Thanksgiving, Black Friday and Saturday flat to slightly down (0.0% to –0.7%). This indicates shoppers were browsing but holding off on committing.

-

Late-week conversion strengthened, with Sunday (+0.7%) and Cyber Monday (+1.0%) outperforming 2024 as shoppers who had been evaluating earlier in the period waited for peak value before buying.

-

This shift also shows a more deliberate shopper, one who takes more time to evaluate options and time purchases more carefully.

-

For brands, this reinforces the importance of sustained visibility and timely retargeting, ensuring high-intent shoppers remain engaged until they are ready to convert.

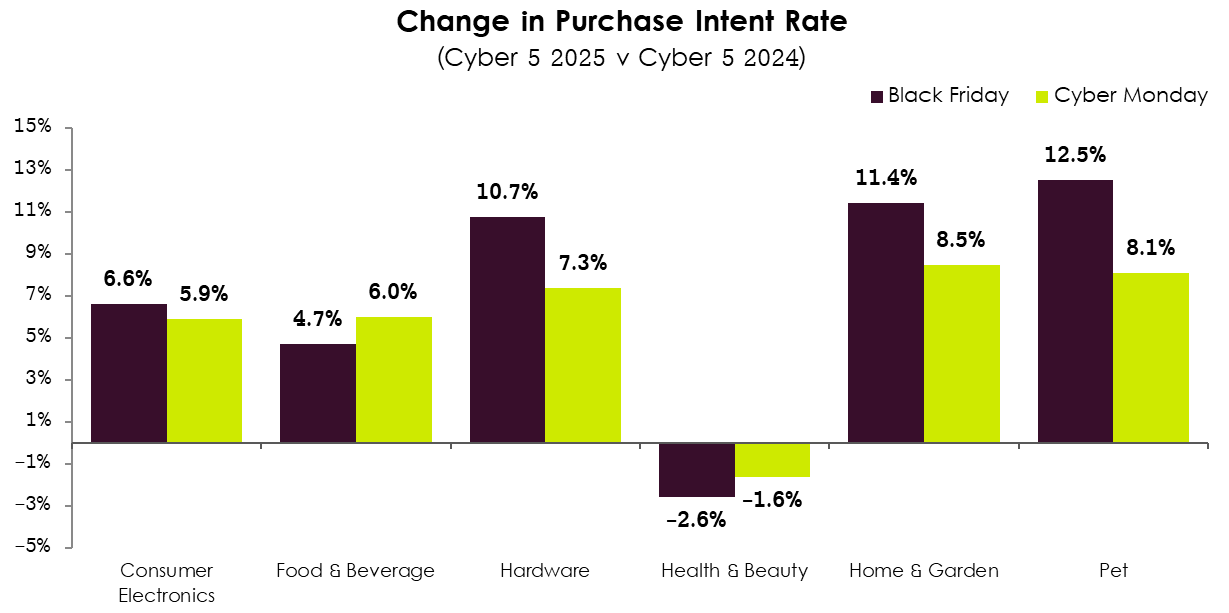

Higher Intent in Many Categories, but Beauty Lost Momentum

-

Health and Beauty was the only category to decline, with intent falling on both key days. Wider market data supports this trend, with Pass_by reporting a 7.7% drop in Black Friday foot traffic to health and beauty retailers even as overall store visits rose. This points to a clear softening in the category this year.

-

Pet, Home & Garden, and Hardware saw the strongest lifts, with Pet growing the most on both Black Friday and Cyber Monday and Home & Garden and Hardware close behind. These gains reflect strong interest in practical, home-focused categories where shoppers see clear value during Cyber 5.

-

Electronics and Food and Beverage also increased, showing steady YoY growth and signalling ongoing demand for high-value tech and everyday essentials.

-

For brands in declining categories such as Health and Beauty, early-season engagement and retargeting become especially important, ensuring interested shoppers are nurtured before their attention moves elsewhere or they decide not to purchase at all.

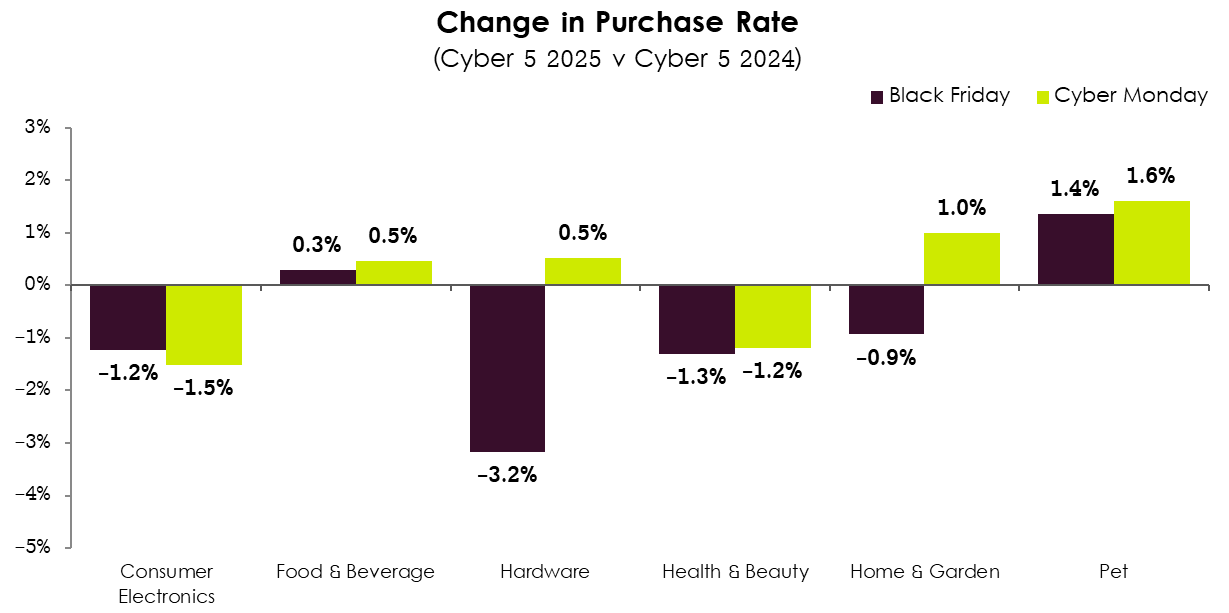

Purchase Rates Fell in Some Categories Even as Total Purchases Rose

-

Consumer Electronics and Hardware drew significantly more shoppers, but many were still in evaluation mode rather than ready to buy. This produced lower purchase rates even as overall sales increased, with high intent stretching the conversion curve. For brands, this reinforces the importance of identifying early-stage evaluators and guiding them with helpful content, comparison tools and reminders as they move toward a decision.

-

Health and Beauty softened during Cyber 5, though shoppers were more active earlier in the season. Purchase rates fell on Black Friday and Cyber Monday, but were noticeably higher in the five days leading into Thanksgiving. This suggests that many shoppers acted during early promotions rather than waiting for the core shopping days, highlighting the value of front-loaded campaigns and early visibility.

-

Pet and Home & Garden saw the strongest improvements in purchase rate, especially on Cyber Monday. Shoppers who showed early engagement in these categories were more likely to follow through later in the period, reflecting strong confidence in deal value and clear product relevance.

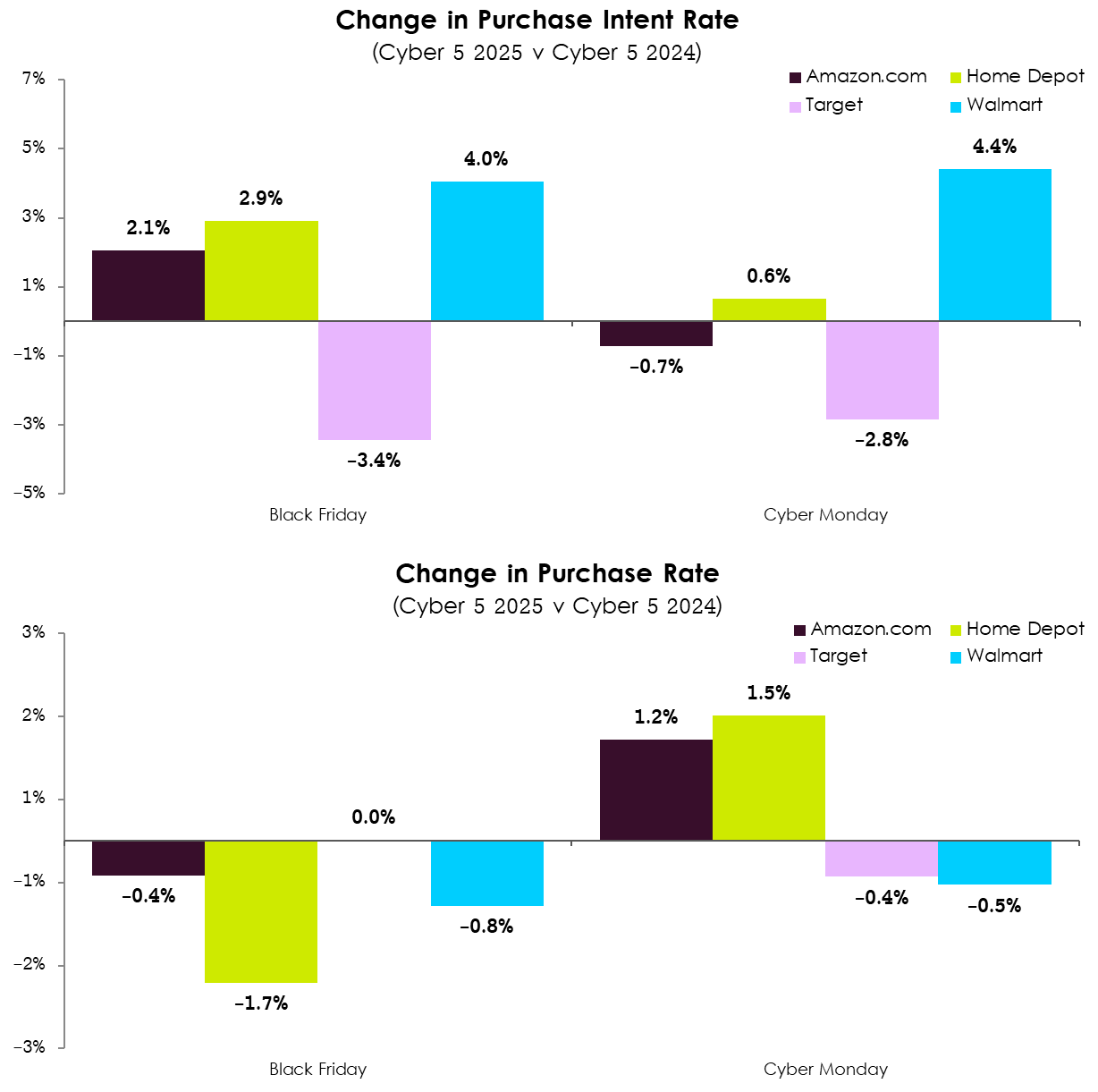

Amazon Converted Strongly, While Home Depot Shoppers Waited to Commit

|

Purchase Rate by Retailer (Cyber 5) |

|||||

|

Nov 27, 2025 |

Nov 28, 2025 |

Nov 29, 2025 |

Nov 30, 2025 |

Dec 1, 2025 |

|

|

Amazon.com |

6.4% |

20.1% |

17.2% |

19.8% |

22.0% |

|

Home Depot |

4.3% |

2.2% |

2.8% |

3.8% |

5.3% |

|

Target |

7.3% |

8.4% |

7.9% |

13.3% |

10.4% |

|

Walmart |

5.3% |

6.7% |

6.0% |

8.1% |

8.5% |

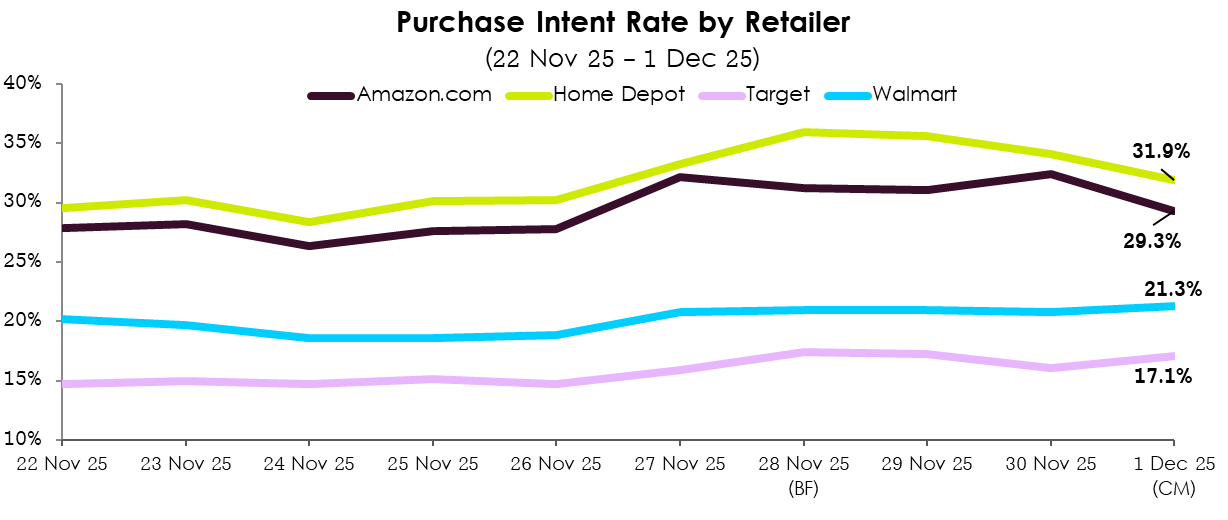

Wayvia’s retailer-level data shows purchase intent steadily for most retailers heading into Cyber 5, but purchase behavior diverged once shoppers reached checkout.

-

Purchase Intent rose into Black Friday, but dipped for Amazon and Home Depot on Cyber Monday, primarily driven by Hardware and Home & Garden shoppers who showed strong intent on Black Friday but waited to buy until Cyber Monday, when deals felt clearer and category purchase rates were higher.

-

Cyber Monday delivered the strongest purchase rate for most retailers, with Target the sole exception, peaking the day before Cyber Monday (13.3%). This highlights how many shoppers delayed decisions while a smaller group moved early once they were confident in price and availability.

-

Home Depot saw its lowest purchase rate on Black Friday, then rebounded on Cyber Monday, reflecting the high consideration involved in Hardware purchases and underscoring the value of retargeting and reminder journeys.

-

As an online-only destination where all transactions are digital, Amazon consistently achieved the highest purchase rates across the period, while omnichannel retailers need to optimize both online and in-store journeys so shoppers have clear visibility of stock, delivery and collection options wherever they choose to buy.

Home & Garden Drives Divergent Retailer Trends This Cyber 5

-

Pet and Hardware were key drivers of Amazon’s YoY lift in purchase intent, with strong Black Friday gains offset slightly by a softening in Electronics on Cyber Monday. Even with this dip in intent, Amazon’s purchase rate still rose on Cyber Monday, supported by stronger Electronics performance and rebounds in Pet and Hardware. This reflects longer decision cycles and reinforces the value of staying present throughout the evaluation window.

-

Home & Garden was the standout contributor to Home Depot’s YoY growth in purchase intent, although Hardware complexity slowed purchase rates on Black Friday. However, rates improved sharply on Cyber Monday once shoppers completed their research, indicating how retargeting can bring high-intent but slower-moving shoppers back when they are ready to buy.

-

Category declines across the board drove Target’s YoY fall in purchase intent, aligning with the retailer’s widely reported challenges after multiple quarters of softer comparable sales. Purchase rates held relatively steady, with Home & Garden gains helping offset drops in Electronics and Toys. This gap between declining intent and stable conversion suggests Target still converts committed shoppers effectively, but is struggling to attract early-funnel interest.

-

Hardware and Home & Garden powered Walmart’s YoY lift in purchase intent, even as purchase rates dipped across most categories on Black Friday before rebounding on Cyber Monday. This pattern indicates Walmart successfully drew many more shoppers into key categories and recovered conversions once undecided shoppers reached the end of their evaluation cycle.

ChatGPT emerges as a high-intent channel with stronger-than-average purchase rates

ChatGPT saw explosive growth as a shopping channel this Cyber 5, and the behavior of these shoppers shows why the platform is becoming an increasingly important part of the purchase journey. Traffic routed through ChatGPT not only grew dramatically YoY but also converted at rates far above many traditional sources. Shoppers arriving from ChatGPT were more decisive and more inclined to complete a purchase, making it one of the most valuable traffic drivers of the period.

Key insights from Wayvia’s data:

-

Traffic to retailers from ChatGPT grew 835% YoY, highlighting how rapidly AI-assisted shopping is becoming part of the discovery process.

-

ChatGPT shoppers converted at an 8.2% purchase rate, significantly higher than Meta’s 2.6%, highlighting how AI-assisted shoppers arrive with clearer intent and stronger confidence.

-

Amazon, Home Depot and Walmart captured most of the clicks from ChatGPT, at 21.6%, 14.8% and 6.5%, respectively, uncovering a clear preference for Amazon.

-

Purchase rates from ChatGPT traffic exceeded each retailer’s Cyber 5 average, including Amazon, Home Depot, Walmart and Best Buy. This indicates that ChatGPT shoppers tend to be more committed and further in their decision-making process when they click through.

-

For brands, the rise of ChatGPT signals a growing opportunity to influence high-intent shoppers earlier, provided they ensure product content, availability, pricing, and retailer links are AI-ready, which would allow AI recommendations to lead directly to confident conversions.

|

ChatGPT Purchase rate Cyber 5 |

Overall Cyber 5 |

|

|

Amazon.com |

27.50% |

17.11% |

|

Home Depot |

6.20% |

3.68% |

|

Walmart |

14.50% |

6.94% |

|

Best Buy |

8.30% |

4.10% |

Conclusion

Cyber 5 2025 revealed a shopper who was highly engaged, value-conscious and increasingly deliberate. Intent rose earlier and higher than last year, but many waited to commit, pushing buying toward the end of the period. Black Friday generated considerable interest, yet Cyber Monday became the decisive moment as shoppers held out for the best deals before converting.

Category trends only reinforced this behavior. Practical, home-focused categories such as Pet, Home & Garden and Hardware saw the strongest lifts in intent and conversion, while Health and Beauty eased both in-store and online.

Another standout trend was the emergence of ChatGPT as a high-intent commerce channel. Traffic routed through ChatGPT grew 835% YoY, and these shoppers converted at significantly higher rates than those from traditional platforms. They also outperformed retailers’ own Cyber 5 averages, highlighting that AI-assisted shoppers arrive more prepared to buy.

Overall, the period revealed a consumer who browses broadly, evaluates carefully and buys with purpose. For brands and retailers, success now depends on staying visible throughout the longer decision window, supporting high-intent shoppers with timely nudges and ensuring the final path to purchase is clear, especially as new AI-driven channels take on a larger role in guiding shoppers to buy.

By

By